In today’s complex financial markets, you have a seemingly infinite array of investment vehicles from which to select. Each investment carries risk, so it’s important to choose wisely if you are selecting just one. Luckily, there are some simple rules that you can apply to help stay out of trouble. In fact, you can manage your investment risk and potentially increase your chances of meeting your investment goals by practicing “asset allocation.”

Asset allocation refers to the way you combine different investments in your portfolio. Generally speaking, there are two primary types of investments, stocks and bonds. Stocks provide ownership, and they’re normally purchased for growth and protection against inflation. Bonds are when you loan money for preservation of capital and a fixed income. So, you need to determine whether you want to be an owner or a loaner, and determine what mix of both asset classes is best suited for your particular goals. For most investors, the asset allocation in your portfolio is one of the most important investment decisions that will determine the long-term return and risk profile of your investments.

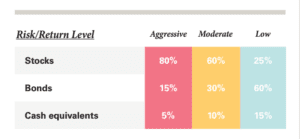

Stocks, Bonds and Cash Equivalents

There are key risks and reward characteristics of all major asset classes.

Stocks: Well known for fluctuating frequently in value, stocks carry a high level of market risk—the risk that an investment’s value will decrease after it has been purchased—over the short term. However, keep in mind that stocks have historically earned higher returns than other asset classes, although past performance is no predictor of future results. Stocks also have a better track record of outpacing inflation, the rising prices of goods and services, than any other asset class and carry low inflation risk.

Bonds: In general, these securities have less pronounced short-term price fluctuations than stocks and offer lower market risk. On the other hand, their overall inflation risk tends to be higher than that of stocks, as their long-term return potential is also lower. Bond returns may be influenced by movements in short-term interest rates. When interest rates rise, bond prices are likely to fall.

Bonds: In general, these securities have less pronounced short-term price fluctuations than stocks and offer lower market risk. On the other hand, their overall inflation risk tends to be higher than that of stocks, as their long-term return potential is also lower. Bond returns may be influenced by movements in short-term interest rates. When interest rates rise, bond prices are likely to fall.

Cash equivalents: These assets are typically short-term, low-risk, low-return and highly liquid. Cash equivalents include U.S. government treasury bills, savings accounts and bank certificates of deposit.

Diversification: A Companion Strategy

Before exploring how you can employ an asset allocation strategy to help meet your investment goals, you should first understand how diversification can help reduce risk and may help increase returns over time. When you diversify yourinvestments among more than one asset class, you increase the chance that if one investment is falling, the return of another in your portfolio may be rising. Neither asset allocation or diversification guarantees against investment loss. Although the ideal asset allocation will vary from person to person, every investor may benefit from having at least a portion of their investable assets in stocks. Studies show that most investors would benefit from adding stocks to conservative portfolios, and maintaining some exposure to stocks for life to help reduce inflation risk and provide the potential for growth.

A Simple Process, With Dramatic Potential

Once you have a carefully crafted asset allocation, maintain it. Review it annually at least, and make alterations as your goals and other circumstances warrant. And rebalance the investment mix if the performance of one asset class throws it off kilter. Do this by adding new money to the asset class that is under-represented in your portfolio, or shift money from the over-represented class to the others. Regardless of the asset allocation strategy you choose and the investments you select, keep in mind that a well-crafted plan of action can help you weather all sorts of changing market conditions over the long term as you aim to meet your investment goals.

For more information call 210.231.0456 or visit www.myacinvestments.com. AC Financial is located at 242 W. Sunset Road, Suite 101 in San Antonio, TX 78209.

Recent Comments